Russia/Ukraine: personal finances in times of crisis

Following recent market instability due to further sanctions on Russia, there is of course some uncertainty as to what this means for investment portfolios.

The markets have already been fragile on concerns over the highest rate of inflation in a generation and the subsequent back-to-back hike in interest rates, with most asset classes being affected. However, it is important to remember that the reopening of global economies following Covid has shown them to be strong (many have in fact surpassed where they were pre-pandemic), markets are strong and the job figures continue to be promising.

Historically, incidents of conflict have had only modest overall investment impact. Markets are not passionate about human tragedy, and are instead solely concerned if there is an economic impact. The tensions between Ukraine and Russia have been brewing for some time now and the conflict had already been anticipated, with fund managers positioning their portfolios accordingly. It is usually the onset of hostilities which is the highest period of uncertainty; following that, there is no longer fear of war beginning, but rather hope for it ending, so markets often rally. Geopolitical tensions tend to favour bonds over stocks, but as the general macro background has been favouring stocks over bonds, there should only be brief market impact.

The only real disruption we should see is in the commodity markets, with both Russia and Ukraine being large producers and exporters of oil, gas and wheat; but again, this should be short-lived. Prices for these will likely increase as supply slows down and sanctions are imposed. However, there would be severe financial penalties should they renege on any contracted deals, so this is unlikely. Furthermore, sanctions are mainly imposed on individuals so this will have little impact to the general markets. Although the price of oil has now hit $105 per barrel, we have seen these prices before, and with inflation over time, the current cost is lower in real terms than that of 2015. Gold on the other hand is set to hit all-time highs as a favoured ‘safe haven’ for investors.

One could argue that this could be an opportune time to ‘buy in’ to the markets. Rockefeller once said “the way to make money is to buy when blood is running in the streets”? Warren Buffett said the same thing a different way. He said “be greedy when others are fearful, and fearful when others are greedy”. Laurence J. Peter of Maxims of Wall Street once said “many an optimist has become rich simply by buying out a pessimist.”

To conclude, I will leave you with some market perspective from which to view this latest period of volatility, to show you that we have been here many times before and have always been able to weather the storm:

- Crisis Events 2008 – 2021: the markets showed overall resilience through major crises events since 2008. The average annual total return of the S&P 500 Index for this period was 11.04%.

- Staying The Course:Over the last four decades since 1980, the average intra-year decline of the S&P 500 has been approximately 14%, showing that volatility is perfectly normal.

- Stocks Won!: what if you invested at the market peak in 2007, before the Financial Crisis? Since then, stocks have still outperformed Cash, Gold, Housing, Treasury Bonds, Oil and Inflation, averaging 10.6% per year to date.

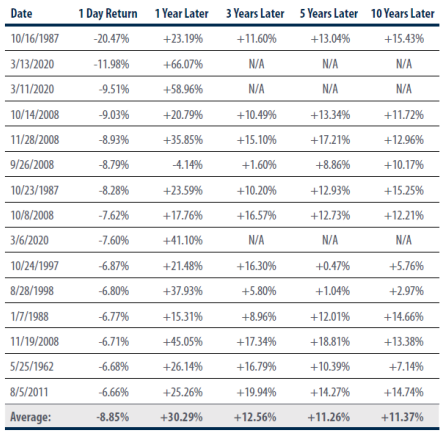

- S&P 500 Performance After Worst Days: a look at 15 of the market’s worst days in history and where the S&P 500 Index stood 1-, 5- and 10-years later.

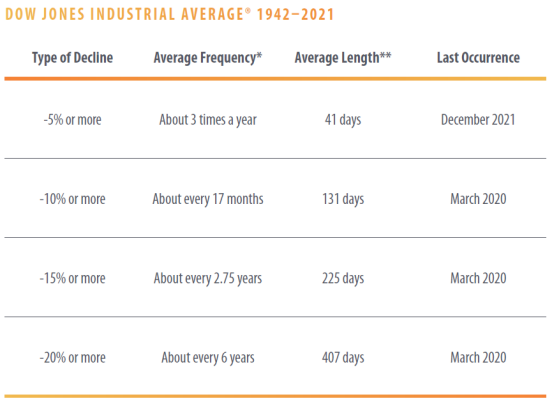

- A History of Market Corrections:declines are an inevitable part of investing. Here’s a look at history to put today’s stock markets in perspective.

In light of all this, if you would like us to review your investments, please do get in touch.

Would you like to know more?

If you feel your business could benefit from our knowledge and expertise, use the form below to contact us and one of our experts will be in touch.