Wilton Property Investments

Property in the United Kingdom may suffer from the political situation over the next few weeks. However, we are sure that the long-term prospects of property in the United Kingdom will remain high. You only have to ask yourself where all the wealthy individuals worldwide are targeting for their residential homes, education of their children, medical services, a base for their private business interests, and where the legal system works better than most. More than ever in the past, it is the United Kingdom and London in particular.

GroupVest PLC – Wimbledon Development, 16% PA

One of Wilton’s clients, GroupVest PLC (GroupVest), has undertaken its own small scale development project in Wimbledon, UK, with targeted returns of 16% per annum.

GroupVest provides an alternative way for HNW Individuals and Sophisticated Investors to participate in, and jointly fund, real estate development opportunities. The proposed investment is a prime re-development opportunity in Wimbledon Town, sourced by GroupVest PLC, and will be developed in partnership with Visu Verum. Visu Verum are an experienced property development company with an extensive track record operating in the exclusive areas of Wimbledon, Coombe, Central London and Surrey.

As GroupVest’s participation structures are designed to minimise risk and maximise returns, each funding opportunity is ring-fenced within a unique SPV with its own security terms. The legal work on such transactions can be complicated and costly, and the due diligence onerous, therefore GroupVest screens all opportunities and appoints its legal representative to act on behalf of the group where appropriate, and continues acting as a security trustee.

The company has exchanged on the site through a dedicated SPV, which was purchased ‘off-market’ for £1.35 Million, and the proposal is to demolish the two existing commercial blocks to construct seven brand new 1 & 2 bedroom flats. The total expected time for the development is 15 months.

GroupVest will be the issuer and therefore directly responsible for repaying the loan notes.

The Outline terms for the GroupVest Loan Note are:

- Issuer: 175 Hatfield Road, the SPV holding the development assets.

- Term: Minimum 12 months, Maximum 24 months (unless extended by consent).

- Coupon: 16%, interest paid upon redemption (simple interest basis)

- Security: 2nd Charge of SPV development assets.

- Guarantor: GroupVest Plc the owner of the SPV.

If this project is of interest to you, please get in touch as soon as possible. This is a fast moving project looking to get underway by this summer.

Urban Study – Student Accommodation, 14% IRR

Urban Study Partners LP (Urban Study) and Wilton have identified an area of commercial property that holds high growth potential. This project presents the opportunity to achieve an IRR of 14% for the period invested, secured by a second charge over the underlying properties. Urban Study is seeking commitments of £3.8 million in preferred finance to supplement the investment programme. As preferential partners, investors will receive all capital + returns before standard equity partners.

Student numbers have risen 34% within the UK and up to 122% for overseas students, creating a growing demand for student accommodation in some of Britain’s best University towns. This provides a unique opportunity to acquire a portfolio of good quality buildings to develop into high end, fully furnished student flats. HESA data shows that 19% of students stayed in University provided accommodation in 2014/15, in contrast to 37% of students choosing to use private sector rental housing. This represents an increase of 58% over the last 6 years, with the rising numbers of both UK and international students creating a shortage of good quality, centrally located student accommodation.

The Urban Study development projects aim to take advantage of rising student numbers and the growing demand for high end accommodation. They have already acquired interests in four new sites, two in Newcastle (204 studios, completing June 2016), an additional site in Newcastle (143 studios, completing summer 2017) and one site in Southampton (199 studios, completing in summer 2018).

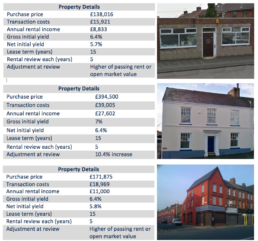

Dental Property Investments – Guaranteed Rental Income for up to 20 years, 6.5% PA

The Dental Property Investment team (DPI) continues to source investment opportunities in this unique sector of commercial property, across the United Kingdom. Once a dental property has been acquired, the property is leased back to dentists under long term contracts of up to 25 years. Wilton has identified the revenues generated by dental property as an area of low risk investment due to IDH (Integrated Dental Holdings) backed contracts which guarantee rental income on the property for up to 20 years. These are subject to fully repairing and insuring the property over the entire lease length, safeguarding the investment to that extent. The dental property sector offers attractive income yields of 6.5%-8% per annum; they are pension compliant and can be tailored to a client’s personal needs. DPI is able to identify properties before they reach the market, offering exclusive deals to its clients.

It is worth noting that the majority of the properties offered were previously residential buildings that have been converted to a D1 space. Should the freeholder wish to convert the property back to residential once the lease expires, there should not be any problem with planning permission as this was the original purpose. The residential value of a property is comparable to the commercial value.

The team is able to assist with the transactions and provide on-going asset management of the property should this be required. Our current offerings are listed below:

Hotel Property Investments, 8% PA

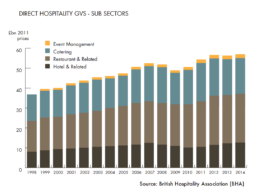

The Wilton Group has recently developed a portfolio of entry-level opportunities to invest in commercial property. The advantage of this is that it allows our clients to spread their investments across multiple sectors, therefore mitigating the risk. One of our most exciting opportunities exists within the hospitality sector of the United Kingdom, ranging from property development to hotel refurbishment. Investments are available from £40k and provide the opportunity to achieve considerable yields of around 8%.

The British Hospitality Association has reported that commercial property in the hospitality sector is stable and growing, and we believe it will continue to generate solid returns in the coming years.

Wilton clients can benefit from our advice and expertise in both sourcing and investing in property. Wilton also offers a secured lending service that provides effective and profitable funding for property developers. If any of these offerings are of interest to you, please do not hesitate to contact us, we would be delighted to tell you more.

Brexit

The impact of Brexit on the UK property market has become an increasingly hot topic of conversation. Analysts have come up with a multitude of predictions, though as with the nature of a referendum, their accuracy remains to be seen. One thing is clear however, uncertainty can bring instability to any market, be it financial or property, and as the deadline for the EU Referendum looms closer, this is becoming more and more apparent. If Britain does vote to leave the EU come June 23rd, Prime Central London would almost certainly be hit the hardest, at least in the short term, with potentially large amounts of property being traded by foreign investors, disrupting the market from their activity. According to a Knight Frank study in 2013, 49 per cent of all Prime Central London buyers were non-British citizens, with 28 per cent not even registered as permanent UK residents.

A number of analysts are questioning what role the EU has played in foreign investment in the UK. Traditionally, what has attracted buyers to London and the UK market has been the political and economic stability, a respected legal system, favourable rules for non-resident landlords and a vibrant culture. Once the initial economic uncertainty dies down, it may be unlikely to have any continuing effect on the price of property either in Prime Central London or the UK as a whole. In fact, freedom from Brussels and the EU may enable changes that could strengthen an already stable market.

Whatever the vote come June 23 2016, Britain is certain to see large changes following the immediate aftermath. The long term effects from these changes remains to be seen, however we expect that London and the UK will remain one of the top choices for any local or overseas investor.